Getting the “Right” Home

Getting the “Right” Home

Finding the right home is still the biggest challenge buyers are faced with in today’s market as is shown in the latest Confidence Index Survey. Assuming the buyers find the “right” home with determination, perseverance and the help of a real estate professional, 88% of all transactions last year required financing to get the buyer’s address on the home. 93% of first-time buyers needed financing.

Pre-approval is an essential step that needs to be handled before buyers begin searching for a home. The benefits to the buyer fall into the category of confidence.

PRE-APPROVAL GIVES YOU CONFIDENCE

- Knowing the amount you can borrow

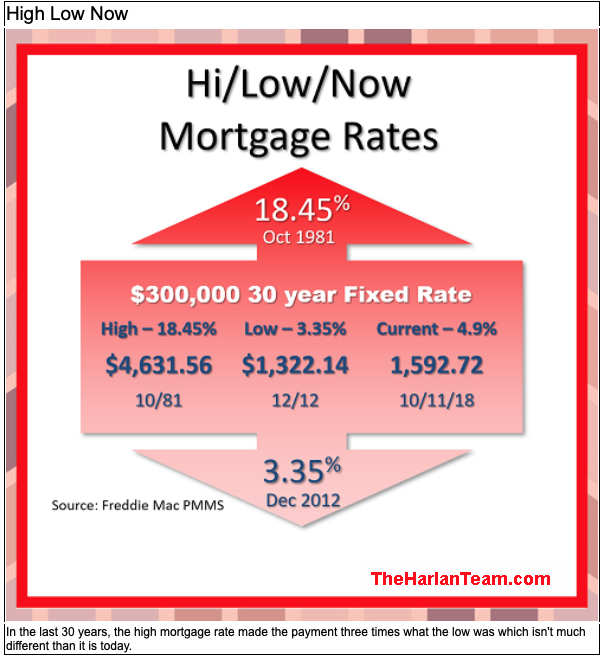

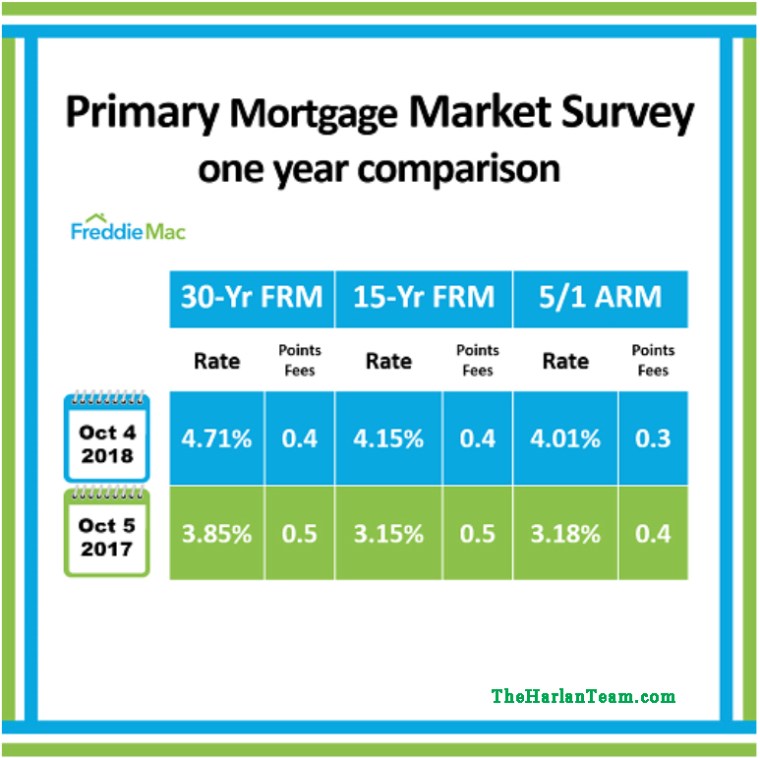

the mortgage amount decreases as interest rates rise - Looking at the right priced homes

price, size, amenities, location - Comparing and identifying the best loan

rate, term, type - Uncover issues early that could affect the most favorable loan terms

time to cure possible problems - Bargaining power to negotiate with the seller and possibly, competing buyers

price, terms, & timing - Settlement can occur sooner after contact is accepted

verifications have already been made

Items Needed for Pre-Approval

- Photo ID

- Two months current pay stubs

- Last two year’s W2s

- Complete copies of checking and savings statements for last three months

- Copies of statements for IRAs, 401k, savings, CDs, money market funds, etc.

- Employment history for last two years with addresses and contacts

- Proof of commissioned or bonus income

- Residency history for last two years with addresses and contacts

- Assets for down payment, closing costs, and reserves; must provide paper trail

- If self-employed, last two years tax returns, current profit and loss statement and balance sheet; copy of partnership/corporate tax returns for last two years if owning more than 25% of company

- FHA requires driver’s license and social security card

- VA requires original certificate of eligibility and DD214

- Other things may be required such as previous bankruptcy, divorce decree

Contact us at (206) 979-9632 or David@TheHarlanTeam.com if you’d like a recommendation of a trusted mortgage professional.

–

– Here is a Seller’s Home Inspection Check List

Here is a Seller’s Home Inspection Check List