Assumptions Make Sense Again

Existing FHA and VA mortgages are assumable at the note rate to owner-occupied buyers who qualify. This can be an alternative to paying higher, current rates and benefit buyers with lower closing costs while saving money on the payment.

For the last 20 years, rates have been steadily coming down and there was no reason to qualify for the assumption when a new loan had a lower interest rate.

Assuming an FHA or VA loan with a lower interest rate will obviously mean lower payments but it will also build equity faster because the amortization schedule is advanced from a new 30-year mortgage. Another benefit is that the acquisition costs on an assumption are much lower than starting a new loan.

In the example in Table One, a couple bought a home two years ago for $400,000 with a 3% FHA mortgage that has principal and interest payments of $1,656. It is now worth $435,000.

Let’s look at a hypothetical situation involving the sale of this home after two years. The savvy listing agent explains that the home may have additional marketability due to the assumability of the FHA mortgage in place.

In scenario #1, the buyer purchases it for $435,000 with 10% down payment at the then, current rate of 5% for 30 years. The principal and interest payment is $2,102. If the home appreciates at 4% annually the equity will be $230,989 in seven years.

In scenario #2, the buyer purchases it at the same price with the same down payment but assumes the 3% mortgage with 28 years remaining. Since he doesn’t have enough cash to buy the equity, he gets a second mortgage for the balance at 5%. The combination of the payments on the first and second are $1,739 or $363 less than the payments in scenario #1.

In seven years, the $363 savings accumulated to $30,492. The future equity is $21,457 larger on the assumption because the first mortgage is at a lower rate and the loan is amortizing faster. In this example, the buyer is much better off assuming the FHA mortgage.

There will be a challenge in identifying which homes for sale have assumable FHA or VA mortgages because for decades it didn’t make much difference to list it in the description. Many MLS’s are not even including fields for existing mortgages.

Finding the “Right” home for a buyer is important but equally important is finding the “Right” financing.

Waiting Will Cost More

Mortgage rates have been kept artificially low by the Federal Reserve since the Great Recession in 2010. There is a whole generation of people who have never known what might be called normal mortgage rates. And then, most of the rest of the adults in America have forgotten what average rates were in the 60’s, 70’s, and especially, in the 80’s when they hit 18.45%.

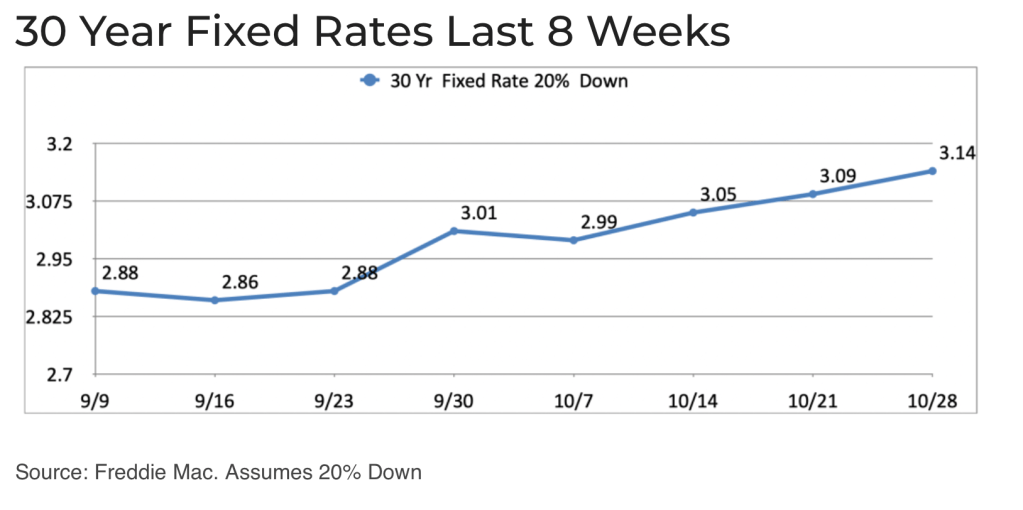

The bottom of the market was February 2021 with 30-year fixed rates were 2.73%. Current rates, as of February 10th, according to Freddie Mac, are at 3.69%. Earlier predictions by NAR, FNMA, Freddie Mac, and MBA were that rates would go as high as 4.00% by the end of the year.

Those estimates may be considered low now based on concerns about inflation and the federal government’s efforts to keep it under control. The Fed has announced a series of policy rate increases for the balance of the year. Mortgage lenders, in anticipation of the rate hikes, have already started raising their rates as evidenced in the rates since January 3, 2022.

It is possible that a year from now, 30-year fixed rates could be at 5% or above. This could make a significant difference in a buyer’s payments especially compounded with rising prices.

A $450,000 purchase price today with a 90% fixed-rate 30-year mortgage at 3.69% has a principal and interest payment of $1,862 a month. If things continue to heat up and the mortgage rate goes up by one percent while the price increases by ten percent, a year from now, the home will cost $495,000 and the payment would be $446 higher each month for the term of the mortgage.

Use the cost of waiting to buy to make projections on the price home you want to buy based on your own estimate of what interest rate and appreciation will do in the next year.

Acting now causes the payment to get locked in at the lower rate and the increase in value belongs to the buyer as equity build-up. Unfortunately, with the current state of supply and demand on housing inventory, waiting to purchase moves the bar higher and higher until some buyers will not qualify.

So You Like Zillow’s Zestimate?

Zillow just closed down their iBuyer program and fired 25% of their company. Their CEO says is was because they can not accurately predict home prices. We have been saying that for years.

Afraid to Sell Because You’re Not Sure You Will Find Your Replacement Home? What If We Could Buy and Then Sell

The decision to buy first or sell first, has always been a little of the “Which came first: the chicken or the egg?” type of question. Is it better to buy another home before you sell your current one or sell the current one before you buy the replacement?

Some buyers don’t have a choice because they need the equity out of the current home to purchase the new one and possibly, their income limits their ability to qualify for having both mortgages at the same time. However, some buyers, with sufficient financial resources, may have other options available to facilitate the move.

A home equity line of credit, HELOC, is a type of loan that a traditional lender like a bank will loan up to the difference in what is currently owed on the home and 75-80% of the value. A borrower is approved for the line of credit and then, can borrow against it as needed. A homeowner with sufficient equity, would want to secure a HELOC prior to contracting for the new home or listing their current one. Typically, the interest will be due monthly. When they sell the home, the loan would be paid off along with any other liens on the property like the first mortgage.

A bridge loan is different in that it is usually a specific amount of money for a short term used to “bridge” the time frame necessary to acquire the replacement property and sell the existing home. The amount available is like the HELOC, usually, up to 80% of the home’s value less the existing mortgage. Some lenders may require being in the first position which may require retiring the existing first mortgage from the proceeds from the bridge lender.

Hard money lenders are a little more flexible in some of their requirements compared to typical lenders, but it comes at a cost. They could charge two to three percent, called points, of the money borrowed and it is paid up-front. The interest rate is typically higher than long-term mortgage money.

Another alternative is to find a conventional lender who has a program that allows you to recast the loan in a specified period. The borrower would get a low-down payment mortgage on the new home and after the original home is sold and closed, the lender will apply a lump sum toward the principal amount owed on the new home and recalculate the payments and amortization schedule. By recasting the loan, the borrower does not go through the process of getting a new mortgage by refinancing and therefore saves the costs involved. Most conventional loans and conforming Fannie Mae and Freddie Mac loans allow a recast after 90-days. FHA, VA, GNMA loans do not allow recasting.

Borrowers with 401(k) retirement accounts may consider borrowing against that asset which could be a lower interest rate than other temporary options. Depending on the size of the 401(k), the amount available to borrow could be up to half the balance or $50,000 whichever is less. If the loan isn’t repaid in a timely fashion, there can be taxes and penalties.

In each of these options, the seller is involved in borrowing money to accommodate a purchase and sale of a home. There will be expenses involved but the advantage is that they have a better chance of realizing most of their equity to complete a purchase before they sell their current home. This is particularly helpful in markets that are low in inventory. It can also make moving from one house to another much easier.

One last option is to consider selling your existing home to an iBuyer or private investor. The attraction to this alternative is that they will make you an instant offer to buy your home and you’ll have cash to use to purchase your new home. These companies or investors, intend to resell the property, so they must discount the price they pay for your property taking into mind they will be responsible for repairs, maintenance, selling fees and other expenses. While it may sound appealing, you may discover that the amount you will realize will be substantially less than if you sell your home in a conventional manner.

If you have questions about Buying First and Selling Later we can do a comprehensive market analysis to indicate market value and the net proceeds you can expect to have. This will assist you in determining which option makes sense for you at this time. We can also recommend lenders and approximate timelines for each alternative.

Removing or Adding a Person to a Loan

In divorce it is common, for the spouse who keeps the home to refinance to remove the other spouse from the loan. Equally as common, first-time buyers who don’t have enough income to qualify may ask a parent to co-sign and must add their name to the mortgage.

Another situation that requires removing or adding a person to a loan could be to qualify for a better interest rate. The difference in a minimally acceptable credit score and something that might be considered “good” could be as much as a 0.5% higher rate for the term of the mortgage.

Consider that a couple is buying a home with a conventional loan, and they have individual credit scores of 760 and 670. The underwriters will price the loan based on the lower of the two scores. A half percent interest on a $400,000 30-year mortgage could have close to $110 a month difference.

A possible solution to this dilemma could be available, assuming the borrower with the higher credit score had enough income to qualify for the mortgage separately. If so, that person would be eligible for the lower rate. The property could still be titled in both names and if so, both would be liable for the mortgage should the named borrower default on the loan.

Another scenario that may arise is perhaps a couple has enough income to qualify for a mortgage but because one of the parties has a lower credit score, it will be priced higher. Consider having a parent or relative added to the mortgage as a non-occupying borrower to help with the credit score. Interest rates are determined on the lowest middle of three scores for the borrowers applying for the loan. Assuming the parent’s score was higher than the lowest score of the couple, it could improve the rate applied to the mortgage loan.

The value of a trusted mortgage professional is very important. They can offer alternatives to situations that could be worth tens of thousands of dollars over the life of the mortgage and in some cases, can make the difference in being approved at all. If you have questions about real estate finance let us know. We have mortgage professionals that have been part of our team for over 20 years.