One of the first steps in a good outcome is knowing a little bit about what you’re about to undertake. By being aware of some of the areas regarding homes that may not come up every year in a tax return, you’ll be able to point them out to your tax professional or seek more information from IRS.gov.

Look through this list of items for things that could affect your tax return. Even if you have relied on the same tax professional for years to look out for your best interests, they need to be aware that there could be something different in this year’s return.

If you bought a home for a principal residence last year, check your closing statement and identify any points or pre-paid interest that you or the seller paid based on the mortgage you received. These can be deducted on your Schedule A as qualified home interest if you itemize your deductions. See Home Mortgage Interest Deduction | IRS Publication 936 .

Keep track of all money you spend on your home that might be considered a capital improvement. Get in the habit of putting receipts for money spent on your home that is not the house payment or utility bills. Repairs are not tax deductible but improvements, even small ones, can be added to the basis of your home which can lower the gain when the home is sold. Years from now, your tax preparer can sift through them and determine whether they’re capital improvements or maintenance. See Increases to Basis | IRS Publication 523 Selling Your Home .

By making additional principal contributions with your mortgage payment, you’ll save interest, build equity and shorten the term of a fixed-rate mortgage. See Equity Accelerator.

If you sold a home last year, the payoff on your old mortgage included interest from the last payment you made to the date of the payoff. That interest is tax deductible. You may need a breakdown of the payoff to the mortgage company; you should be able to get that from your closing officer.

If you refinanced your home, unlike a home purchase, points paid to refinance are not deductible as interest in the year paid; they must spread ratably over the life of the mortgage. See Home Mortgage Interest Deduction | IRS Publication 936 .

For homeowners who have lost a spouse, there is an exception regarding the exclusion on the sale of a principal residence. If the surviving spouse concludes a sale of the home within two years of the death of their spouse, they may exclude up to $500,000, instead of $250,000 for single taxpayers, of gain provided ownership and use tests are met prior to death.

The two-year period begins on the date of death and ends two years after that date. See Sale of Main Home by Surviving Spouse | IRS Publication 523 Selling Your Home .

There could be significant tax consequences to a person selling a home that was received as a gift as compared to receiving the home through inheritance. With a gift, the basis of the donor becomes the basis of the donee. With inheritance, the heir usually gets a stepped-up basis and avoids potential unrecognized gain. See Home Received as Inheritance | IRS Publication 523 Selling Your Home .

This is meant for information purposes only and advice from a qualified tax professional should be sought to find out about your individual situation.

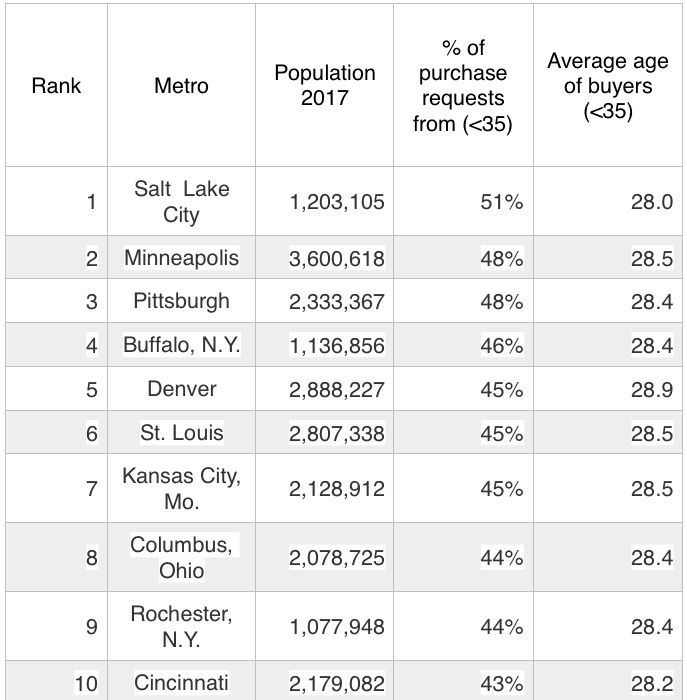

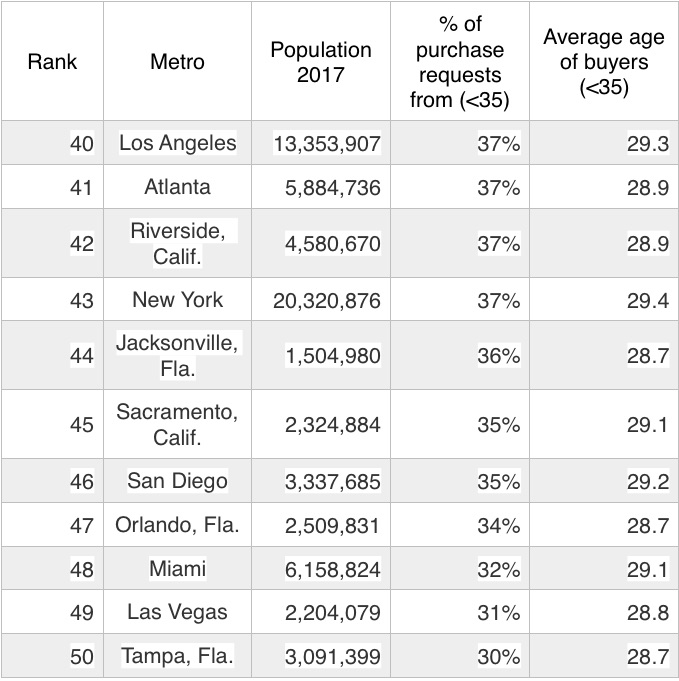

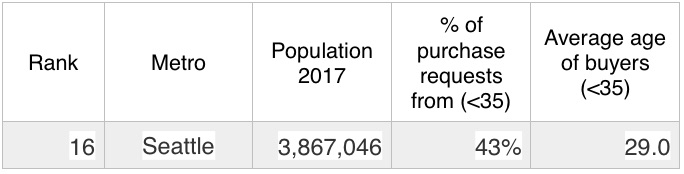

A November 2018 study conducted by the online lending firm LendingTree reported that more millennials as defined by those born between 1982 and 2002 are thinking about becoming homeowners. In fact a full 21% of those surveyed between the ages of 18 to 34 said they plan to purchase a home in the next 12 months. That is up from 14% just a year ago.

A November 2018 study conducted by the online lending firm LendingTree reported that more millennials as defined by those born between 1982 and 2002 are thinking about becoming homeowners. In fact a full 21% of those surveyed between the ages of 18 to 34 said they plan to purchase a home in the next 12 months. That is up from 14% just a year ago.